Car manufacturers and car insurance: an unlikely pairing?

by Clemens Reidel, Movinx Chief Insurance Officer

The customer not thinking about car insurance is the future of car insurance. Here’s how we’re making that happen:

Consumer demand: embedded car insurance

Car industry chatter has long toyed with the idea of embedded car insurance. All signs point to a consumer who is looking for a vertical car buying experience.

After all, customers don’t want to – and shouldn’t be expected to – know everything about insurance! That’s the job of OEMs and insurance carriers: to provide the best fit for the consumer.

What OEMs and insurance companies can leverage is the trust that is already inherent in the customer-OEM relationship.

Last year when Tesla started rolling out insurance integrated into all its electric vehicles that chatter turned into a roar. Auto-covering customers the future of car insurance. Here is how Movinx is helping OEMs and traditional insurance companies build partnerships to reach that future.

Embedded car insurance

a quick recap:

Car insurance that comes with the car when you buy it from the manufacturer. A vertical car buying experience is one where everything the customer needs to succeed and get out on the road is handled at the moment of sale.

A big customer loyalty opportunity for OEMs:

With automobiles becoming more and more connected, car insurance providers are no longer the first to know about an accident – it is the OEM who knows first. Canadian Underwriter explains the process well, but here is the TLDR version:

Given the immediate data the OEM receives via the car, with an integrated insurance, OEMs rather than insurance providers can organize the claim, instruct drivers which repair shops to use for their vehicles, and manage the repair within minutes of an accident.

For the customer, this seems like a dream. For OEMs this customer desire offers huge potential. By turning insurance into something that is integrated into the customer experience, OEMs can increase customer loyalty.

From a business point of view, OEMs want drivers to use OEM issued parts to fix their vehicle after an accident. Drivers usually want this too; it’s reassuring to have your car replaced with parts made by the manufacturer.

But insurance companies usually try to avoid this out of cost. Some insurance providers offer OEM insurance, which guarantees OEM parts – for a premium.

Opportunity for insurance providers?

Insurance companies have been reluctant to adopt vertical or embedded insurance. Embedded insurance would mean the provider cannot ask the regular gamut of questions that they usually pose in order to prequalify a driver for insurance. This equates to a fear of risk and unknown for the insurance provider. This is logical; it’s insane to ask an insurance provider to insure 100,000 drivers for $59/month without knowing the driver’s history, where they drive, or where they park. Right? Not quite.

Insurance companies who resist collaboration with OEMs are going to find “working with different vehicle types and data sources, are very challenging and require a global approach to agreements, across platforms,” according to Lexis Nexis.

But insurance companies that look forwards towards partnerships can benefit immensely. According to Milliman, given the data the OEMs have access to, OEMs could help increase insurance profitability by integrating their services vertically: “If car manufacturers can estimate loss costs more accurately than insurers can, this will translate into more accurate insurance premiums, which is important for insurance profitability.”

Building partnerships between OEMs and insurance companies

A solution that delivers a best-fit insurance product that truly protects drivers is one that relies on a partnership of both OEMs and insurance sectors. This solution should take advantage of technology and data synergies in the increasingly connected automotive space.

And you know what? It’s possible, because we’re already on it!

At Movinx we help make sure insurance providers have the information they need to insure drivers, without requiring the OEM to ask dozens of extra questions at the point of sale. We’re here to iron out all the details to bring car insurance to the future.

Of course, there are tricky points to navigate: each market and each country has different insurance regulations and providers. That’s why Movinx takes on insurance by region, to make sure there is seamless scaling of embedded insurance for OEMs in each market.

Movinx is building the bridge between OEMs and insurance providers. We’re bringing car insurance into the future. Learn more.

Want to read more?

Movinx is scaling up to transform the automobile insurance industry. Read more industry insights from our team, here.

Related Posts

Fast, easy, direct

The future belongs to insurance companies which can provide mobility protection right at the point of sale – online. To conquer this digital world, insurance carriers still have a lot to learn.

Movinx CEO Q&A: embedded, global mobility insurance

Digital Insurance received responses via email from Dr. Caro Gabor, CEO of Movinx, a joint venture between Swiss Re and Mercedes-Benz.

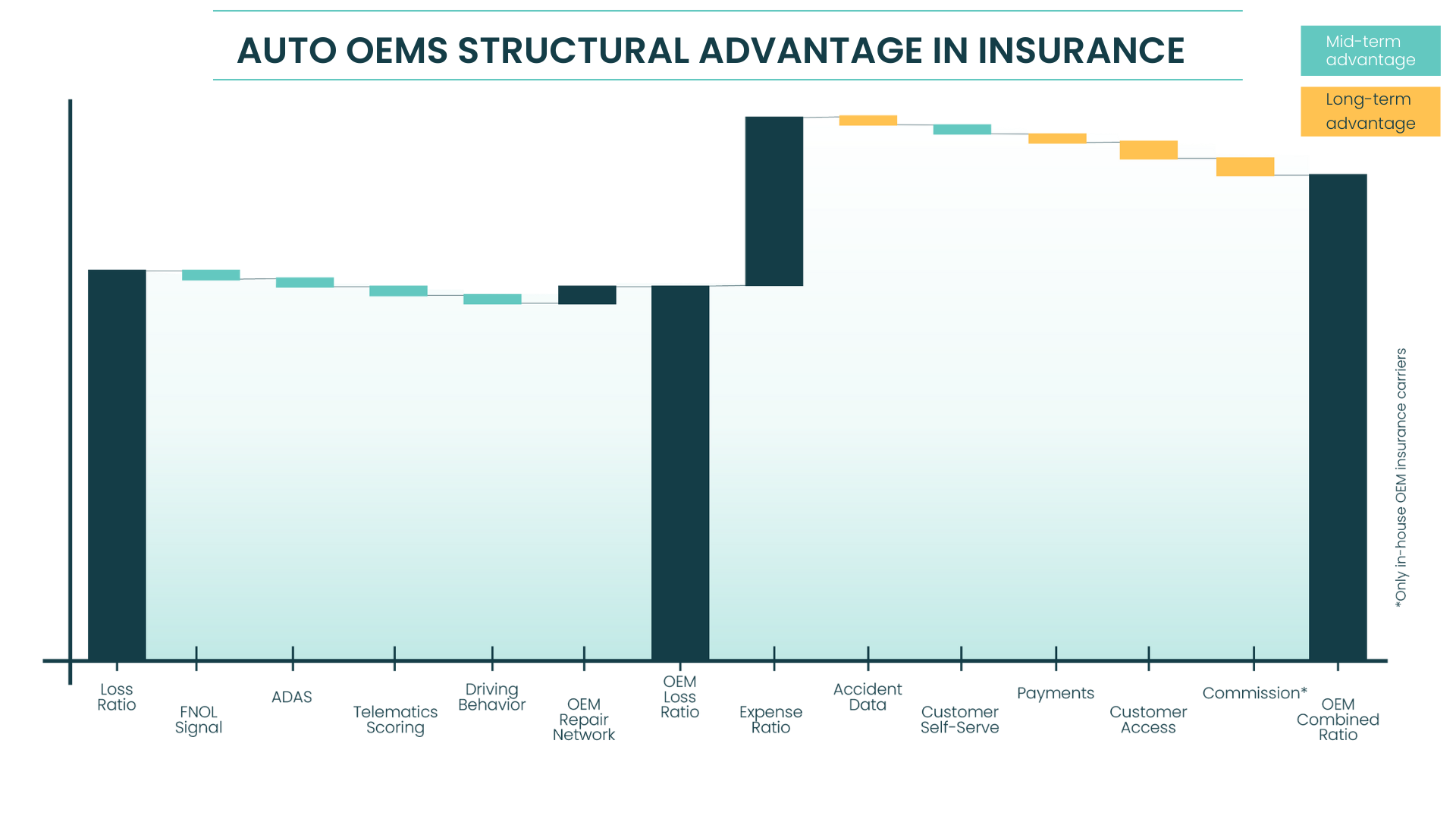

Auto OEMs’ “unfair” structural advantage in insurance

Automotive OEM insurance has recently evolved. Despite challenges around price competition across diverse customer groups – and simultaneously across US 50 states – OEMs have been working through a range of models to merge the two sectors (insurance and automotive), with an aim to make insurance part of the car purchase journey. This analysis describes thre

Demystifying acquisition costs in embedded insurance

How have acquisition costs typically worked for insurance providers and how is embedded automotive insurance changing that? Movinx’s Chief Insurance Officer, Clemens Reidel shares all.