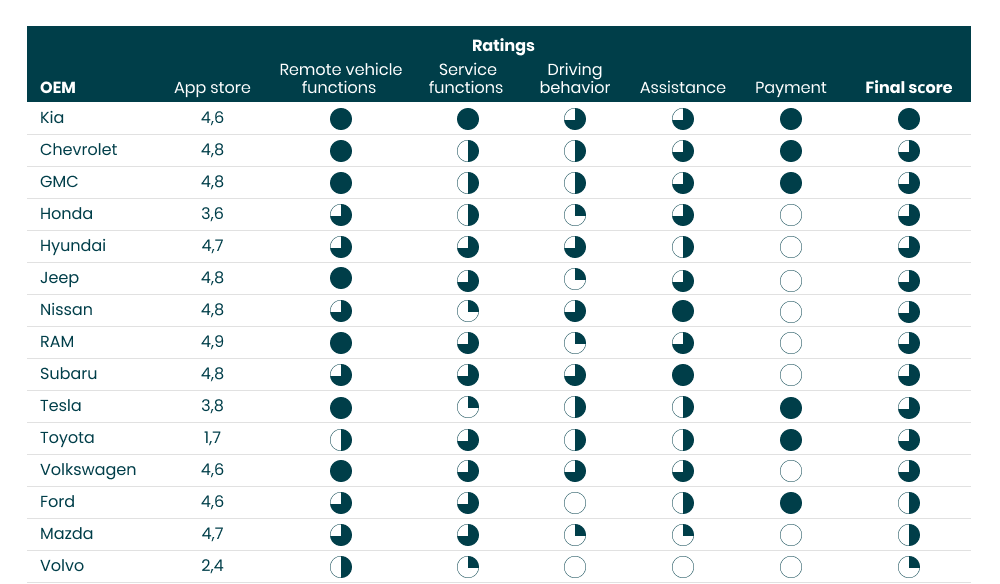

Car apps: Who has the best?

by Andreas Schroeter, Movinx Chief Product Officer

In my previous post I predicted that car apps will have a similar impact on the car market as the iPhone did on the mobile phone market. In this post I will deep dive into the car apps as of today.

Current status of car apps

I analyzed car apps currently available in the market. I focused on the car manufacturers with highest US sales of new cars. I also included Volvo, as their subscription approach with the XC40 appeals to the digital natives, in particular.

There are already a wide range of capabilities available, I clustered them around five main functionalities:

- Remote vehicle functions: open/lock door, start/stop, preheat/precool, car locator, honk horn/flash lights, fuel/charge level, locating fuel/charge stations, send address to navigation system

- Service functions: vehicle health/status, schedule service, maintenance reminders, recall alerts, service history, owners’ manual, warranty information, dealer locator

- Driving behavior: driving score, guest driver profiles, curfew alerts, speed alerts, boundary alerts

- Assistance: emergency assistance, roadside assistance, concierge services, stolen vehicle recovery, claims filing

- Payment: finance/lease payments, EV charge payments

When analyzing the apps, I only looked if the feature was available. The customer ratings reveal that many customers also put emphasis on the usability/design of the app (not part of this analysis).

Most important of all was the reliability of the functionality in the app, which seems to be a problem across all car manufacturers for a small portion of customers (I did not account for this in the analysis as there was no available quantitative data). For example, Toyota released a new version of their app which seems to be quite buggy, resulting in a 1.7 App Store rating (with most car apps rated >4.5).

Most car manufacturers offer a very similar package of remote vehicle functions, they have de facto become the norm.

Regarding service functions, vehicle health status and service scheduling is the most common. Helpful information that otherwise just sits in a paper folder like service history, warranty information and recall alerts are less common, but from a customer standpoint, would be great to have in a single place.

Functionality around driving behavior is rather the exception. Besides the driver score (known from telematics tariffs) there are several services that cater to different niches, such as the ‘curfew alert’ to check whether your child came home in time or not, or the ‘boundary alert’ to ensure your car stays in a certain area.

Most of these functions can be leveraged to offer car insurance – something that is the foundation of Tesla’s own insurance program. With Tesla claiming an average saving of 20-40% of the insurance premium this is an immediate benefit that could – and should – be marketed in any car app.

Assistance functions mostly resemble the known OnStar program: getting help in case of emergencies, a car breakdown etc. They provide customers with peace of mind by connecting the driver to a call center in case of accidents, for example. There are first cases of it going further, such as Tesla allowing the customer to file claims through the app.

Payment functionality is currently the exception.

While this might not be so relevant for recurring monthly payments (e.g. the lease), there are two areas that make the payment functionality within the app a natural fit. For electric vehicles, allowing EV charging via the app fits perfectly in the whole ecosystem of knowing your charge status and finding charging stations with your navigation. In the near future, cars will come with pre-installed features that customers can unlock temporarily or upgrade to, such as adding enhanced automated driving (with Tesla already doing it).

Customers expect the app to work, they now consider this an integral part of the car. A buggy/non-functioning app will be judged as negatively as when the car makes weird noises. Or, as one customer in the App Store put it:

So, after several more attempts, several more errors, several minutes of spinning loading animations, I have resigned to the fact that I cannot set a timer for my car. I legitimately wish I had not purchased the [the car]. This app is that bad.

To sum up:

Overall, Kia offers the most functionality.

All manufacturers offer a good basic set of remote vehicle functions. Almost every manufacturer charges a subscription fee (with either long free trial periods or a free bundling option when buying a new car) beyond a very basic functionality, with the exception of Ford.

The two manufacturers standing out the most are Tesla and Volvo.

While Tesla is at the forefront of car development, its app has some very advanced features (payment, autopilot car summoning, claims filing), but is missing some key functions (boundary alerts) that are standard amongst others. It might be that Tesla plays in its own league and focuses their efforts on functionality that could become a game changers.

Volvo’s app is subpar to everyone else’s, which is reflected in their poor overall App Store rating – a real disappointment to their XC40 subscription for digital natives. Or, as one app store customer put it:

Volvos are great, safe, comfortable, almost sexy and almost a top tier luxury car. But it stays just short of that so that’s it’s main consumer base can still afford them. They are wonderful vehicles. And then there is the app. (…) If you want a easy to use car app with worthwhile features then look beyond the Volvo.

In the next post, I will analyze the massive financial impact car apps will have on the auto industry.

Want to read more?

**This article is part of a three-part series:

Last week’s article: ‘The next multi-billion dollar frontier for car manufacturers – hint: it’s not EVs’ can be read here.

The final article: ‘How car apps will transform the auto industry on will be published next week, on May 31, here.

Movinx is scaling up to transform the automobile insurance industry. Read more industry insights from our team, here.

Related Posts

The next multi-billion dollar frontier for car manufacturers – hint: it’s not EVs

The next multi-billion revenue opportunity market is coming from somewhere unexpected. It’s not electric cars - front and center of every car manufacturer’s vision - it’s car apps.

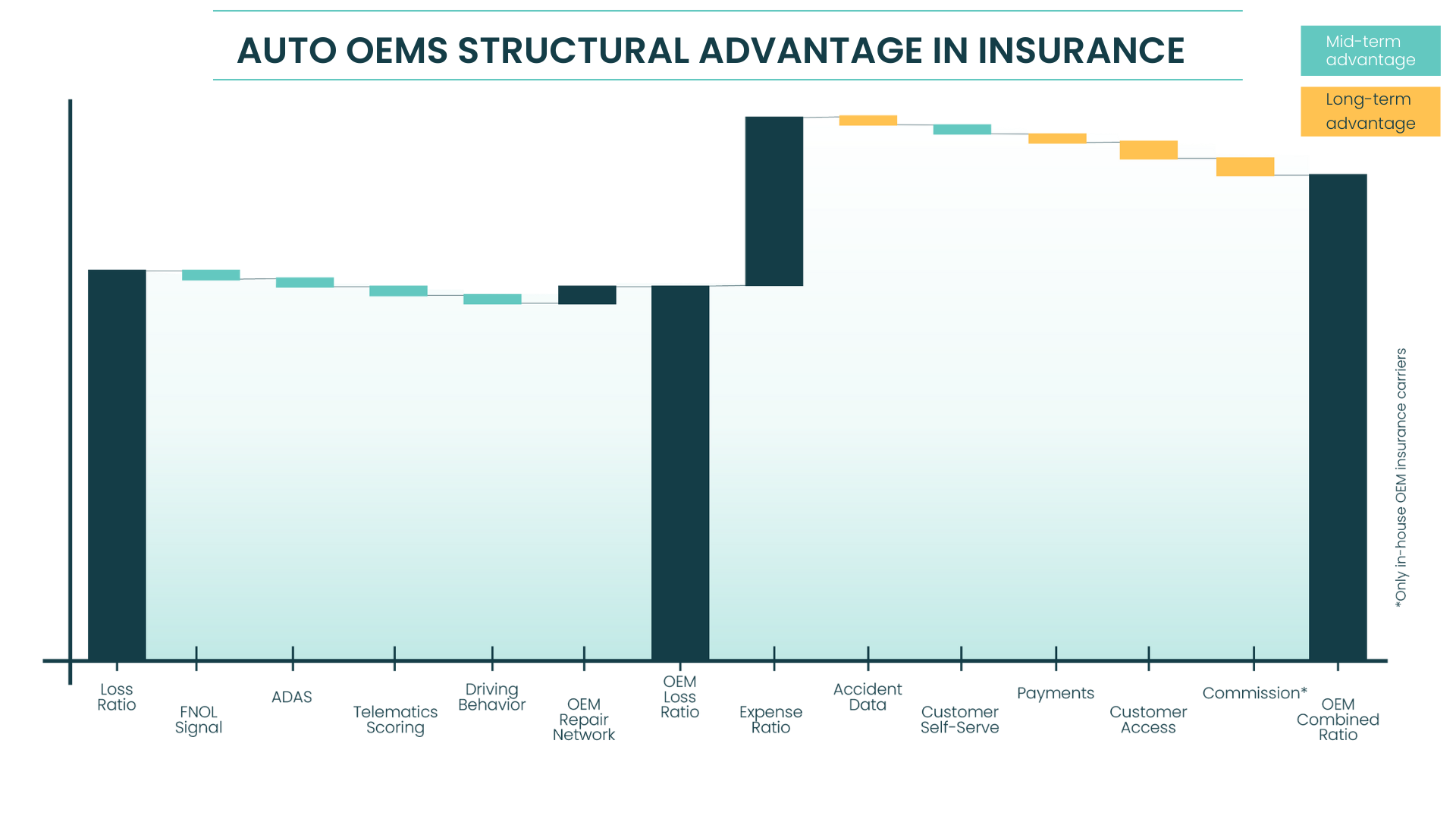

Auto OEMs’ “unfair” structural advantage in insurance

Automotive OEM insurance has recently evolved. Despite challenges around price competition across diverse customer groups – and simultaneously across US 50 states – OEMs have been working through a range of models to merge the two sectors (insurance and automotive), with an aim to make insurance part of the car purchase journey. This analysis describes thre

How do we classify ‘embedded insurance’?

“Are you an insurance company?”“Do you sell insurance in car dealerships?”“Do you tell people what’s the cheapest auto insurance?”

The tipping point: Are automotive OEM’s finally taking the wheel on insurance?

Automotive OEM insurance has recently evolved. Despite challenges around price competition across diverse customer groups – and simultaneously across US 50 states – OEMs have been working through a range of models to merge the two sectors (insurance and automotive), with an aim to make insurance part of the car purchase journey. This analysis describes thre