The tipping point: Are automotive OEM’s finally taking the wheel on insurance?

By Dr. Andreas Schroeter and Keith Gaudin, Movinx Product team

Auto OEMs turn to insurance

Since the humble beginnings of affinity programs, automotive OEM insurance has rapidly evolved. Despite the challenges around price competition across diverse customer groups – and simultaneously across 50 states – they’ve been working through a range of models to merge the two sectors (insurance and automotive), with an aim to make insurance part of the car purchase journey.

Getting this done is no easy feat: technology between insurance carriers and OEMs are not always aligned to be able to easily insert insurance in the purchase journey, let alone leverage connected car data needed for building price-competitive insurance models, and regulatory barriers or customer behavior across all states make if virtually impossible to deliver a consistent – and coherent – customer journey across the board. Still, to date, the challenge remains: how can auto OEMs increase insurance penetration?

Enter embedded insurance.

As recently demonstrated by companies like Carvana/Root and Tesla, embedding insurance within the car sale journey is not only vital: it’s the only way to lift penetration rates and make the customer journey more enjoyable (at least as enjoyable as buying insurance can be).

Seamless experience is the key to customer satisfaction; it’s what they have come to expect, just like financing is an integral part of the modern car sale process,.

Leading car manufacturers are already in the OEM-insurance game with programs like Ford Insure, Toyota Insurance, GM’s OnStar Insurance, and Tesla Insurance; each offering unique, bespoke benefits and value-add features.

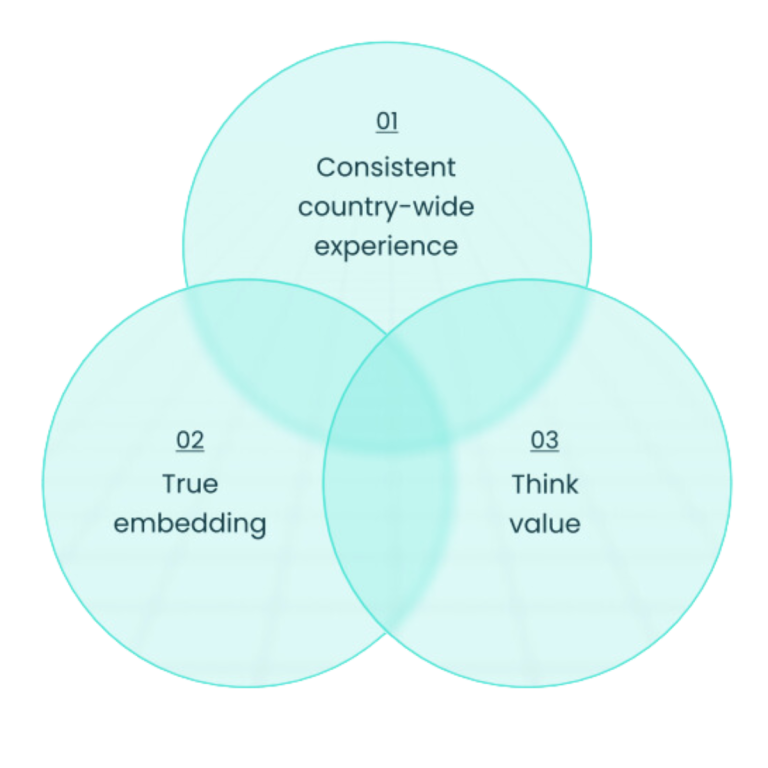

Our analysis shows us that, as more players have entered the OEM-insurance space with their own – not always optimum – insurance product offerings, not all customer journeys are created equal. When it comes to OEM-led car insurance, we’ve found there are three ingredients that lead to better outcomes for insurance programs:

This analysis was authored by Dr. Andreas Schroeter, Chief Product Officer and Keith Gaudin, Principal Product Manager, US. They form part of Movinx’s product team, the company’s experts in insurance customer experience. Movinx is a global insurtech specializing in embedded auto insurance solutions, with a focus on OEM-driven solutions; it’s a licensed producer in all 50 states in the US.

Want to receive more of our analyses?

Integrated insurance doesn’t happen overnight and that is why Movinx exists. We’re keen to share what we’re learning from our experience and research witht he wider sector, so if you want to stay up to date, and receive our future reports, fill out the contact form below, and we’ll do the rest. Don’t worry – we don’t spam.

Related Posts

What’s new about ‘embedded insurance’?

How can embedded insurance make a difference? Talk about the need to vertically integrate, maximize value chain and why.

The virus as a digital booster

As in other industries, the pandemic has also triggered a boost in the digitalization of processes and products in the insurance industry.

The next multi-billion dollar frontier for car manufacturers – hint: it’s not EVs

The next multi-billion revenue opportunity market is coming from somewhere unexpected. It’s not electric cars - front and center of every car manufacturer’s vision - it’s car apps.

At the wheel in real time

Because more and more data can be collected individually and in real time, insurers are facing major changes. The greatest opportunities will open up in the near future for car insurers, but providers must know how to use them.