Movinx CEO Q&A: embedded, global mobility insurance

Digital Insurance received responses via email from Dr. Caro Gabor, CEO of Movinx, a joint venture between Swiss Re and Daimler Insurance Services. Dr. Gabor discusses Movinx, auto industry trends and embedded insurance.

Could you tell me about Movinx?

The automotive industry as well as the auto insurance sector are undergoing significant transformation. There are developments on the technological side, such as e-mobility or automated driving. Also, the business model side changes from car ownership to usage, leading to more focus on rental and subscription models.

To stay ahead of this transformation Swiss Re and Mercedes-Benz entered a strategic partnership for automotive and mobility insurance services in October 2020.

Movinx was established as a joint venture by entities of Swiss Re and Mercedes-Benz Mobility Group. Movinx integrates automotive and mobility insurance products in a fully digital and seamless way at the point of sale of mobility service providers. In addition, it empowers OEMs and mobility companies with a platform that connects to primary insurers and various data providers to offer the best possible customer experience for mobility insurance around the globe.

Related Posts

How do we classify ‘embedded insurance’?

“Are you an insurance company?”“Do you sell insurance in car dealerships?”“Do you tell people what’s the cheapest auto insurance?”

Fast, easy, direct

The future belongs to insurance companies which can provide mobility protection right at the point of sale – online. To conquer this digital world, insurance carriers still have a lot to learn.

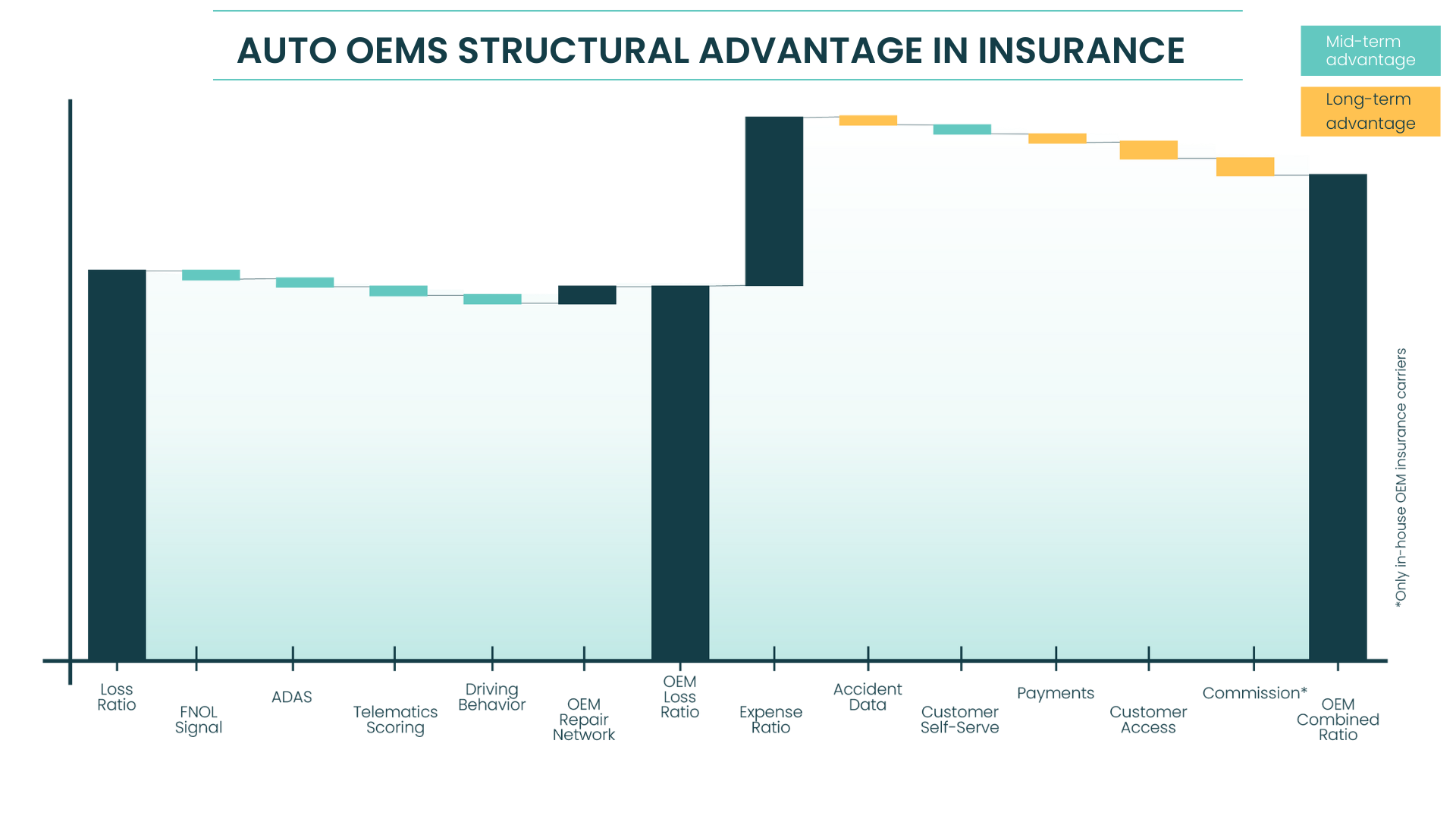

Auto OEMs’ “unfair” structural advantage in insurance

Automotive OEM insurance has recently evolved. Despite challenges around price competition across diverse customer groups – and simultaneously across US 50 states – OEMs have been working through a range of models to merge the two sectors (insurance and automotive), with an aim to make insurance part of the car purchase journey. This analysis describes thre

The tipping point: Are automotive OEM’s finally taking the wheel on insurance?

Automotive OEM insurance has recently evolved. Despite challenges around price competition across diverse customer groups – and simultaneously across US 50 states – OEMs have been working through a range of models to merge the two sectors (insurance and automotive), with an aim to make insurance part of the car purchase journey. This analysis describes thre