Fast, easy, direct

By Caro Gabor, Movinx CEO

Embedded journeys are all around us.

Insurance is just a few clicks away in new car configurators of large car companies, repair cost add-ons are already part of the purchase package of e-SUVs, smartphone manufacturers already provide warranty extension at the click of a button when a customer purchases a new device.

For the most part, insurance companies continue to be pushed through the established channels of brokers and agents, but we can already see that this will not remain the case for too long. In the future, the distribution of insurance products will be directly embedded at the point of sale of whichever journey a customer may need protection for. And this journey is already shifting to digital – more expediently so since the start of the pandemic and the increased appetite for online solutions.

One-click insurance is key.

Digitalization will encourage bundling of more products at the point of sale – such as including insurance with the purchase of new cars – but it won’t stop there. Insurance products sold online need a range of additional features to appeal to customers and diminished attention spans in the saturated online environment.

An important example is that they should be easily calculable and binding, without the need of additional signatures, checks and balances, or further documentation. In the ideal scenario, the customer would add the product to the shopping cart with a single click, without having to fill out additional 20 to 40 data fields, as is commonplace today, before a pricing estimate or offer can be seen.

Of course, this is only possible if insurers get involved in their risk calculation and pricing on the individual data that the customer is willing to share when buying. It is already clear that a few relevant data points will still be necessary so that the risk can be assessed.

These offers must be designed in such a way that they are digestible by the customer who is barely scanning this information in small screens and devices. With a warranty extension, this is arguably easier to achieve, for car or home insurance coverage, it can get a little trickier.

Even more complex products should be designed in a way that is more user-friendly and engaging for customers, so they can more readily recognize their benefits and are more willing to buy them spontaneously. It is not yet the case today.

Packaging comes next.

The key online distribution channel for insurance products is when they’re sold as part of a package with other products. Online giants (i.e. Amazon) already operate in markets around the world with impressive growth rates. Naturally, cooperation with them opens up enormous opportunities for insurers.

These platforms also place special and higher demands on insurance products. They want to offer the most convenient, flexible, fast and globally consistent customer experience. And if we compare these requirements with the current abilities – and willingness – of insurers, it doesn’t always look good for them.

Excellence wherever the customer is.

When it comes to a consistent global customer experience, insurance products are almost always regionally positioned even with the larger insurance carriers. In quotation and underwriting, customers want immediate access to what their insurance premium will be, calculated in real time with their specific data. Ideally, they also want to, click “buy” to immediately receive documents by email. Fast, easy, direct. But for now, only a few direct insurers can do this, and only for a few standard products.

To enable this consistency, insurers will fundamentally have to develop new products and, of course, involve actuarial services, a process that can take several months and incur high costs. This is the opposite of what agile digital platforms, basing their works on rapid integration and iteration, expect.

The Amazons and Airbnbs of the world will not integrate an expensive and complex insurance product that they can no longer tweak. They continuously test and improve their own products based on the customer experience and optimize, for example, product integration or pricing. They learn what works and what doesn’t directly from customer behavior. Adaptability, high speed and continuous reiteration is what they will demand from the insurers they work with.

Fast, easy, direct.

These are must-haves for insurers to gain limitless access to new customers through digital companies. These companies are able to use data to make the best recommendations for their customers, and to decide which insurance products they will offer – from which insurer.

If insurers do not want to degenerate into pure risk providers, while digital platforms develop and price the insurance product, are responsible for customer service and handle the claims, they must strengthen these core skills and stay relevant.

This article was first published in Versicherungsmonitor on May 5, 2021.

Related Posts

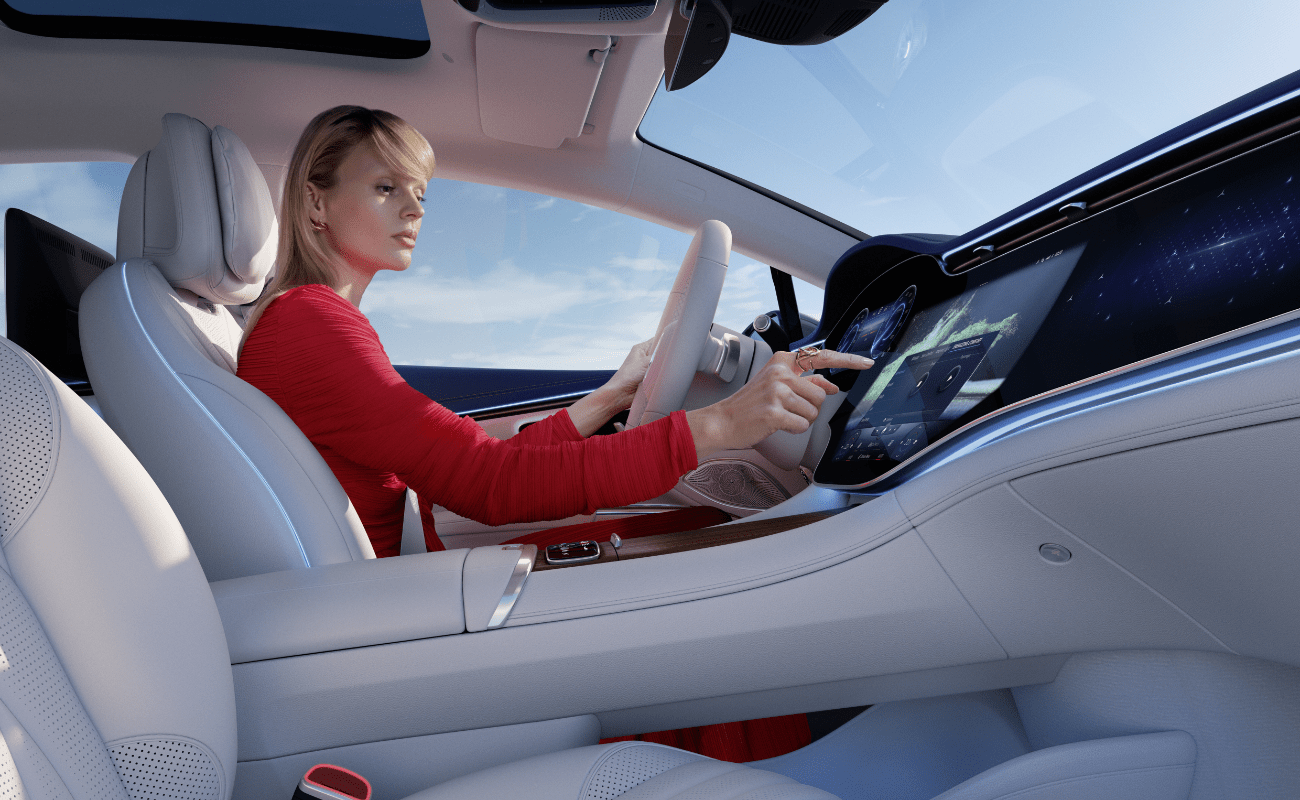

At the wheel in real time

Because more and more data can be collected individually and in real time, insurers are facing major changes. The greatest opportunities will open up in the near future for car insurers, but providers must know how to use them.

Telematics in auto insurance: today and tomorrow

Movinx’s insurance product expert Zy-Ralene du Crest gives us the rundown on how Movinx is leveraging telematics to better manage the risk portfolio of insurance companies and create safer drivers.

10 predictions for car insurance in the next 10 years

The car insurance industry is facing probably the largest disruptions of the last decades, due to the increasing availability of data and the imminent mass-adoption of AI. Our team of experts in insurance and tech, combined with our footprint across the US and Europe, has provided us with core audience insights on this and emerging trends. This is what our 10

Demystifying acquisition costs in embedded insurance

How have acquisition costs typically worked for insurance providers and how is embedded automotive insurance changing that? Movinx’s Chief Insurance Officer, Clemens Reidel shares all.