At the wheel in real time

By Caro Gabor

Because more and more data can be collected individually and in real time, insurers are facing major changes. The greatest opportunities will open up in the near future for car insurers, but providers must know how to use them.

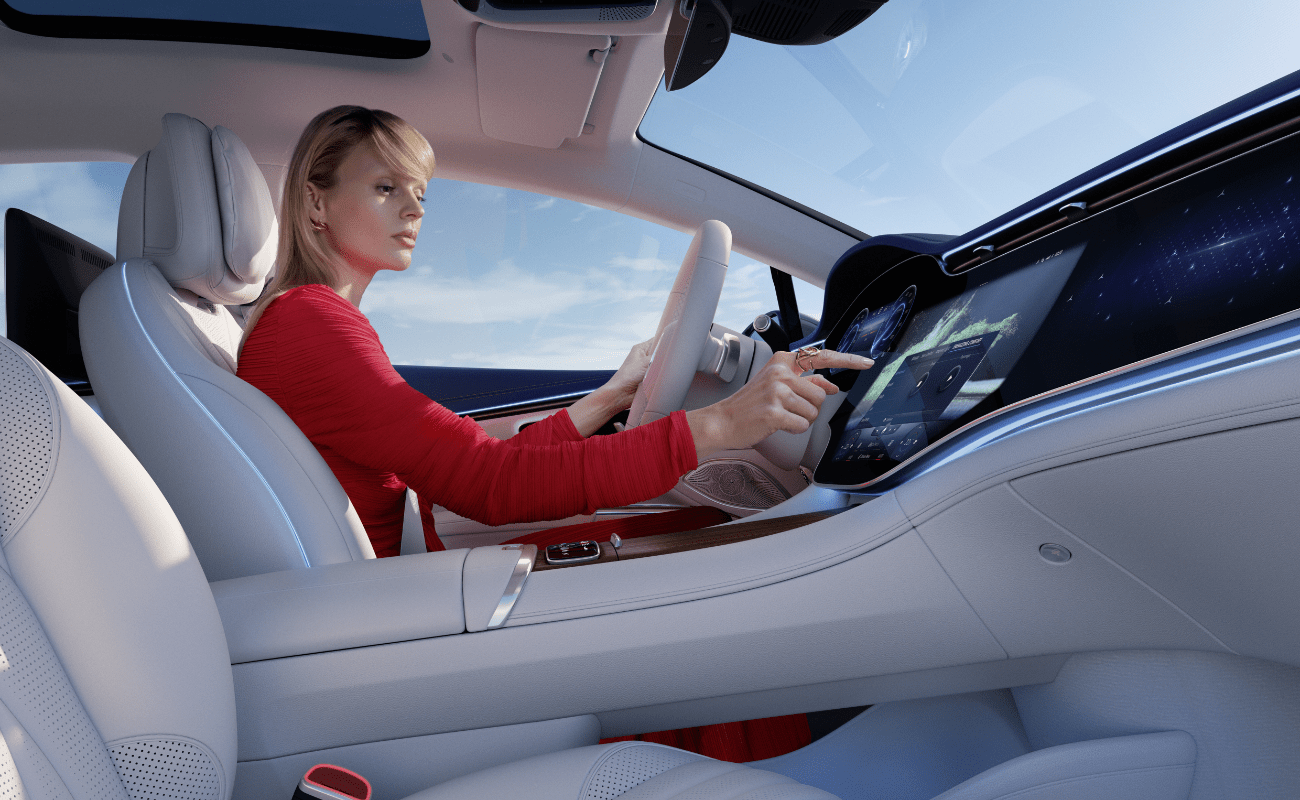

Currently, more and more drivers are installing apps from their car insurers on their smartphones. Other users rely on a black box or use a stick for the cigarette lighter. All these systems locate the vehicle via GPS, continuously log factors such as acceleration, braking maneuvers or driving behavior in curves and send this information to the insurer’s company computers.

This way, insurers can create detailed behavioral profiles and identify potential risks. In return for the voluntary transmission of this data, the customer receives a cheaper insurance premium – when driving carefully, of course.

The providers of “telematics” tariffs, also known as “Pay-How-You-Drive”, calculate the prices for their car insurance on the basis of concrete driving behavior and current data. At the moment, this makes them the exception in the industry.

The majority of all insurance products continue to be calculated according to rigid historical data. For example, the risk assessment of household contents insurance is strictly based on the living space and with conventional car insurance, it stubbornly depends on metrics such as age, claim history and where the car is parked.

In the future, the connected world will allow us to use individual and real-time data – and not only with car insurance. Fitness trackers, home assistants and smartphones already provide detailed data sets insurers can use.

In the case of health insurance, the tariff could then be based on the real-time information from a smartwatch. Household contents insurance would remain up to date with information from the smart home heating sensor. Insurers in the USA are already installing their own water sensors and automatically blocking the water pipe in an emergency. But that’s not all.

In the future, a variety of new sensors will work in clothing, glasses, household appliances or shoes. By 2025, 42 billion connected devices could be deployed worldwide, the World Economic Forum estimates. These devices deliver huge, finely granulated data sets that will feed new data ecosystems.

The first profound changes are already happening in auto insurance, with telematics tariffs are spearheading this development. Additionally, modern vehicles are equipped as standard with a variety of Advanced Driver Assist Systems. These systems massively reduce the accident risk and provide much more realistic data on driving behavior – and thus on risk assessment – than history and statistics could ever do.

Soon, insurers will need to process such data generated in real time so enable appropriate reactions. This could be an individual price estimate, warnings or compliments in real time for driving behavior or even a voucher for a driving safety training.

Such a detailed evaluation of individual driving behavior has two sides: on one hand, insurers benefit from the more realistic tariffs as well as from more customer support for innovative insurance products. Roads and highways will also become safer if more drivers are encouraged to comply with driving laws. And thanks to price pressures, fewer and fewer older, environmentally harmful cars will be on the road without safety systems.

On the other hand, insurers must prove that they can handle sensitive transaction data responsibly. Many consumers will fear that they will become a “transparent driver”. The data collected could be sought for a number of reasons, such as in the event of an accident. The police, accident opponents and others could demand access to it. In addition, digitalization must not lead to the long-term risk compensation in the collective of all insured persons being terminated – and each insured person only paying according to his or her personal risk status. The US state of California has already banned such tariffs precisely for this reason.

Consumers are divided on this issue. According to an Europe-wide study with more than 13,000 end customers, around 40 percent of all respondents were already willing to exchange data for discounts with their car insurance in 2016. On the other hand, however, there were 21 percent strict technology objectors who did not want to disclose their data under any circumstances.

As late as 2020, in a survey for a German insurance company, more than half of those surveyed found it right that good drivers have to pay less for their car insurance than bad drivers. But a third rejected the classification according to driving behavior more or less decisively.

It will be interesting when the industry eventually starts using artificial intelligence to process real-time data. This technology will fundamentally change car insurers: away from recording and paying for damages, towards predicting and preventing accidents. And that’s really good news, given that around 3,000 people die on German roads every year.

Source: this article was first published in Versicherungsmonitor on September 8, 2022.

Related Posts

Telematics in auto insurance: today and tomorrow

Movinx’s insurance product expert Zy-Ralene du Crest gives us the rundown on how Movinx is leveraging telematics to better manage the risk portfolio of insurance companies and create safer drivers.

What is Telematics really?

Do you consider yourself a good driver? If so, you’re in good company with more than 70 percent of German drivers. Yet only a little over 50 percent of people agree that good drivers should pay less for auto insurance than bad drivers. Surprising, isn’t it?

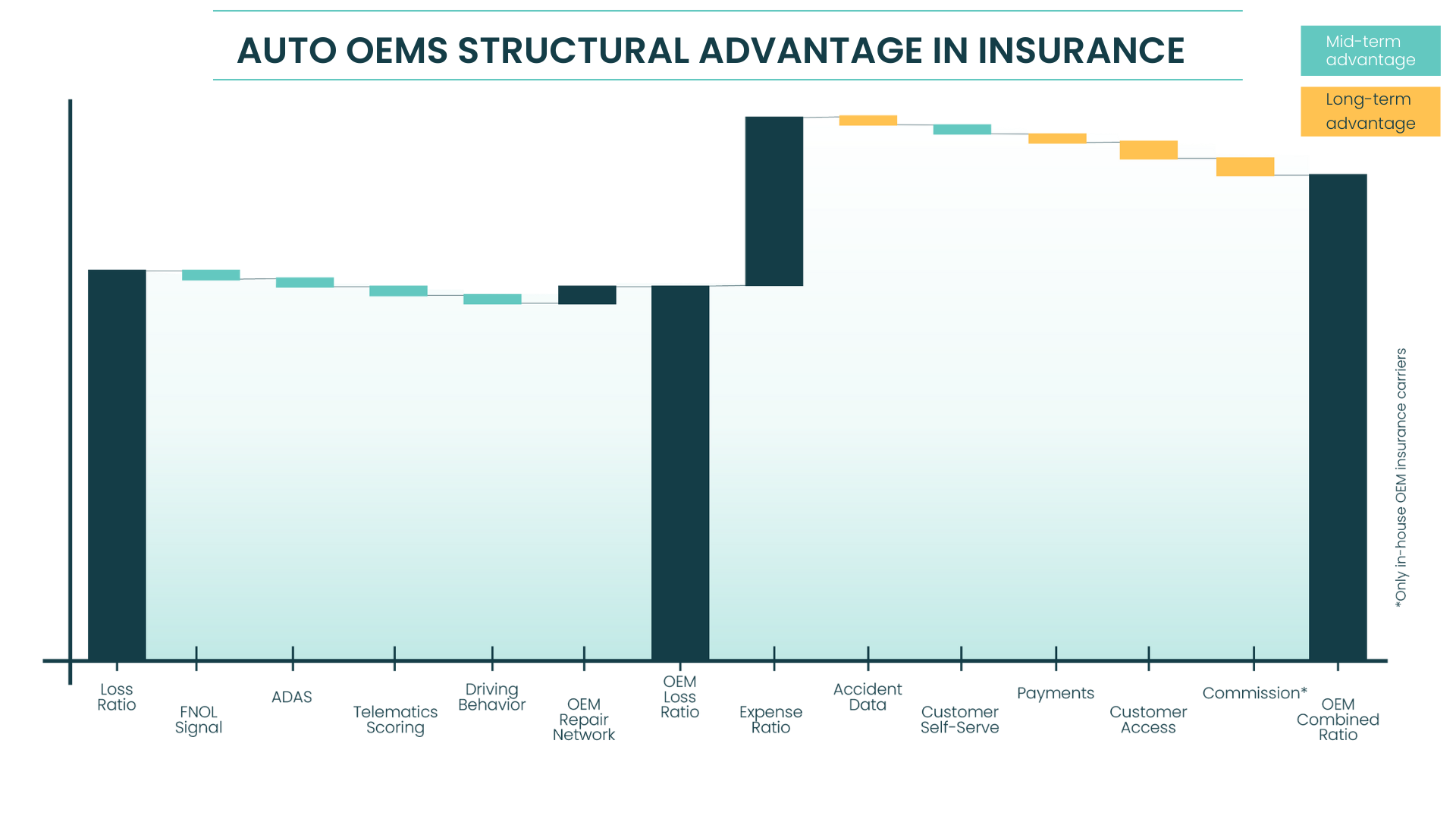

Auto OEMs’ “unfair” structural advantage in insurance

Automotive OEM insurance has recently evolved. Despite challenges around price competition across diverse customer groups – and simultaneously across US 50 states – OEMs have been working through a range of models to merge the two sectors (insurance and automotive), with an aim to make insurance part of the car purchase journey. This analysis describes thre

The tipping point: Are automotive OEM’s finally taking the wheel on insurance?

Automotive OEM insurance has recently evolved. Despite challenges around price competition across diverse customer groups – and simultaneously across US 50 states – OEMs have been working through a range of models to merge the two sectors (insurance and automotive), with an aim to make insurance part of the car purchase journey. This analysis describes thre