How do we classify ‘embedded insurance’?

by Clemens Reidel, Movinx Chief Insurance Officer

Are you an insurance company?

Do you sell insurance in car dealerships?

Do you tell people what’s the cheapest auto insurance?

…These are some of the most common questions I get when I tell people I work at Movinx.

The conversation gets even more complicated when I talk to former colleagues in the insurance industry.

The legacy of structure

You see, the insurance industry has two main features: it’s been around for a long time and it is highly structured. As a consequence, insurance folk developed an intricate system of classifying each player’s business model along the value chain:

- insurance carrier,

- broker,

- captive agent,

- independent agent,

- managing general agent, and

- third party administrator.

With the rise of insurtech, this expanded event further as new “boxes” were created:

- neocarriers,

- insurance as a service (IaaS),

- situational insurance, and

- community-based insurance.

They all offer a specific ‘customer experience’ for their target group.

Not classifying, embedding

The Movinx business model is very simple: we put the customer first because we believe it’s the best business model to offer something that is desirable to real people. The only catch is that hardly anyone of us finds buying insurance a truly desirable thing to do. Does anyone know people who enjoy shopping around for insurance?

I think it’s safe to say no. So we decided to make auto insurance invisible!

Finding and buying (as well as leasing or financing) a car is a personal choice about your way of individual mobility. Individual mobility comes with risks, and modern cars come with several safety features to limit those risks. Insurance is the last resort to financially protect you and others. We see no reason why insurance should be the only safety feature that you need to buy separately from your choice of individual mobility. That’s why we’re “embedding” it: you pick your vehicle and we will make sure it comes with all the required and appropriate coverage – just like any other feature that makes a car your car.

As being invisible is our ultimate goal, the success of our business model is not defined by a specific ‘customer experience’ but rather ‘no experience’ so you can simply enjoy the ride.

Want more information?

If you want to learn more about how Movinx does it what does. Reach out to our Partnership team.

Related Posts

Movinx CEO Q&A: embedded, global mobility insurance

Digital Insurance received responses via email from Dr. Caro Gabor, CEO of Movinx, a joint venture between Swiss Re and Mercedes-Benz.

At the wheel in real time

Because more and more data can be collected individually and in real time, insurers are facing major changes. The greatest opportunities will open up in the near future for car insurers, but providers must know how to use them.

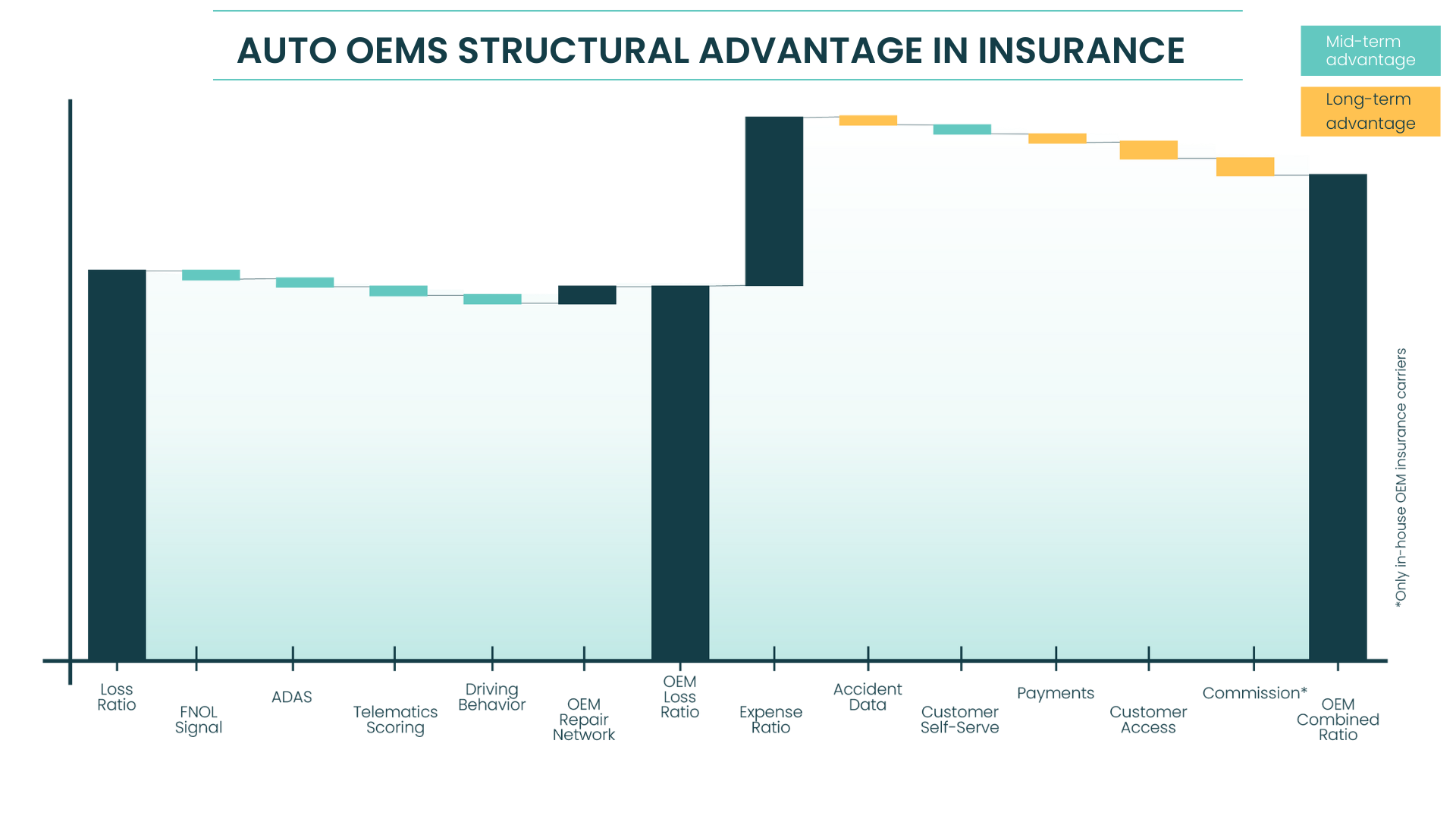

Auto OEMs’ “unfair” structural advantage in insurance

Automotive OEM insurance has recently evolved. Despite challenges around price competition across diverse customer groups – and simultaneously across US 50 states – OEMs have been working through a range of models to merge the two sectors (insurance and automotive), with an aim to make insurance part of the car purchase journey. This analysis describes thre

Demystifying acquisition costs in embedded insurance

How have acquisition costs typically worked for insurance providers and how is embedded automotive insurance changing that? Movinx’s Chief Insurance Officer, Clemens Reidel shares all.