What is Telematics really?

By Clemens Reidel

Do you consider yourself a good driver? If so, you’re in good company with more than 70 percent of German drivers. Yet only a little over 50 percent of people agree that good drivers should pay less for auto insurance than bad drivers. Surprising, isn’t it?

The answer is ‘no’ for one obvious reason: nobody, not even the extremely smart people in insurance companies, knows exactly what constitutes good driving. This is what telematics is all about.

The concept of insurance is simple: driving a car is great but comes with the risk of significant damage to yourself and others. Insurance distributes the risks of individual drivers across a large number of people who pool money (the insurance premium) to be paid out to those who suffer a damage. The distribution is only fair if those who bring a higher risk to the pool contribute more than the ones who are less likely to cause a damage.

To achieve this “fairness”, the insurance industry uses various conditions for each insured driver to quantify how much risk they bring to the pool. Examples for the so-called rating factors are the value, age and engine power of your car or in which region the car is operated. The biggest influence factor is how the car is driven and insurers use conditions like age, number of previous accidents, occupation and kilometers/miles driven for premium calculation.

Whilst the assumptions used for the calculation are supported by empirical data from statistics, they are not necessarily fair and can even be discriminating for the individual. Contrary to statistical averages there are, for instance, prudent young drivers or people who learned their lesson from a previous accident. Yet those groups are most likely to be charged the highest insurance premiums.

Telematics bridges this assumption gap. It complements statistical average assumptions with factual data about each individual driver’s behavior.

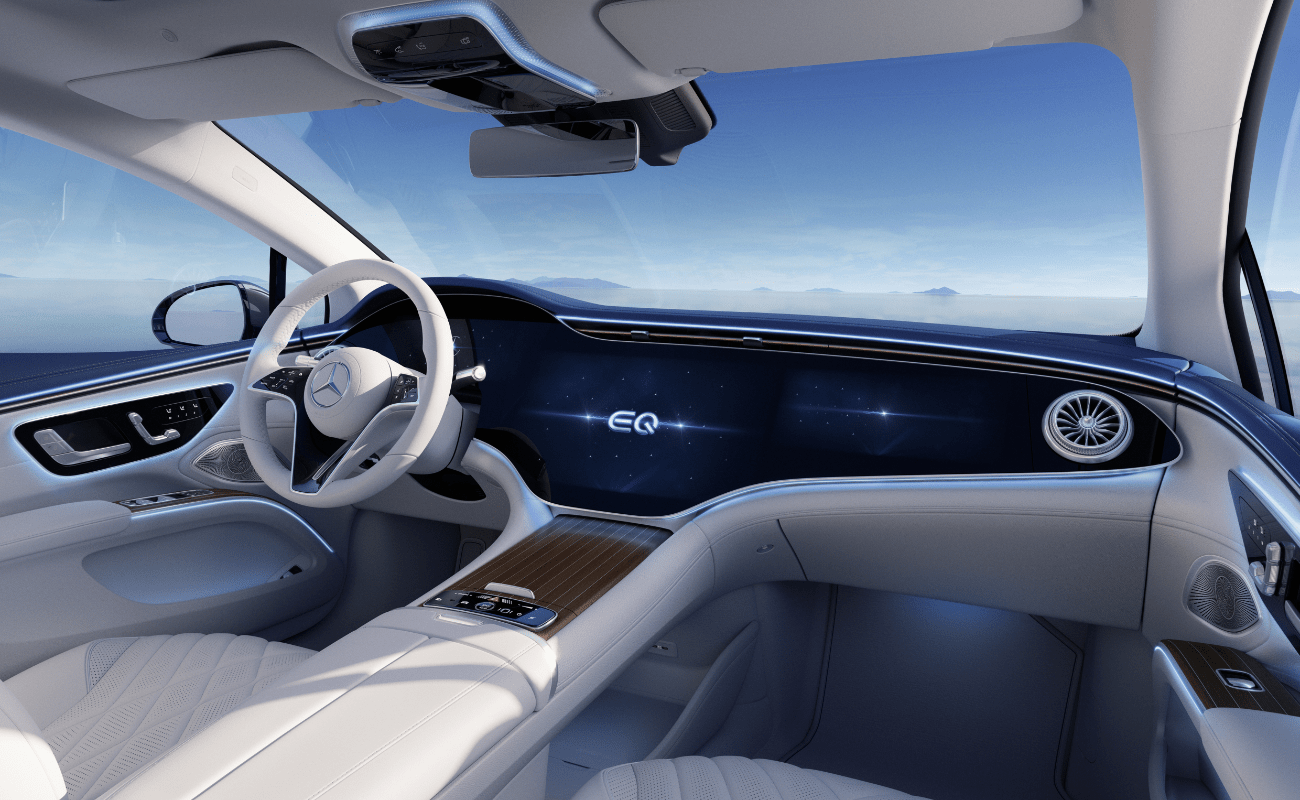

As vehicles are increasingly connected, equipped with enabling technology, they allow for this to happen quite effectively. Sensors measure acceleration, braking, cornering (the way of driving curves) and speed. This data is transferred via cellular network to an analytics company who calculates a score based on the measured driving data that represents how good your driving behavior actually is. Once this is done, only the score (not the driving data) is submitted to your insurance company. The better your driving score the more discount you will get on your insurance premium.

Telematics is the answer to what good driving means. It is an enabler for more fairness by considering everyone’s individual behavior instead of relying on outdated assumptions.

Related Posts

How do we classify ‘embedded insurance’?

“Are you an insurance company?”“Do you sell insurance in car dealerships?”“Do you tell people what’s the cheapest auto insurance?”

Fast, easy, direct

The future belongs to insurance companies which can provide mobility protection right at the point of sale – online. To conquer this digital world, insurance carriers still have a lot to learn.

Demystifying acquisition costs in embedded insurance

How have acquisition costs typically worked for insurance providers and how is embedded automotive insurance changing that? Movinx’s Chief Insurance Officer, Clemens Reidel shares all.

10 predictions for car insurance in the next 10 years

The car insurance industry is facing probably the largest disruptions of the last decades, due to the increasing availability of data and the imminent mass-adoption of AI. Our team of experts in insurance and tech, combined with our footprint across the US and Europe, has provided us with core audience insights on this and emerging trends. This is what our 10